(a) (i) Competitive demand refers to the demand generated for substitutes, where substitutes are defined as products or services that can be used in place of each other.

(ii) A subsidy is a grant given to suppliers of certain goods or services by a government in order to keep prices below the production costs.

(b) (i)

As seen in the above diagram, panic buying of petrol causes the demand for petrol to increase. This increase in demand produces a rightward shift of demand, thereby increasing both quantity and price level.

(ii)

As shown in the above diagram, supply increases when OPEC decides to increase production. Such a supply increase causes the supply curve to shift rightward, resulting in an increase in quantity and a fall in price.

(c) (i)As explained in the passage, people living in the countryside, commuters, and low income earners will be the most affected by rising petrol prices due to an unequal distribution of income. In particular for petrol, demand is rather inelastic due to a lack of substitutes, making it hard for consumers to find alternatives. This is especially problematic for low income earners who spent a larger proportion of their income on this product. Rising petrol prices may further affect the distribution of income in that it could transfer the wealth of consumers to the oil producers/OPEC.

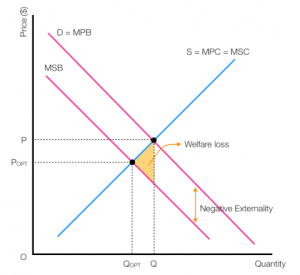

(ii) Rising petrol prices are likely to reduced demand, the extent of which largely depending on the price elasticity of demand. This decreased demand would have positive effects on the environment. The consumption of petrol creates a negative consumption externality. As seen in the diagram below, the MSB curves lies below the MPB curve. Lower demand and therefore less consumption of petrol would decrease the effect of the negative externality.

(d) In paragraph 3, three main measures to be taken by the government are proposed. First, it is proposed that the government should lower public transport prices. Such an action would cause more people to use public transport and less people using petrol (due to substitution effect). This decreased demand for petrol would have lower the effects of negative consumption externalities resulting from petrol and have beneficial effects on the environment. Increasing tax allowance for travel and increasing income support for the low paid would have similar effects on the distribution of income. These policies could encourage the low paid to instead use public transportation, decreasing their reliance on petrol.

Leave a comment